Is Your Athens, GA Business Ready for Payment Processing?

Home / Blog / Is Your Athens, GA Business Ready for Payment Processing?

Yes, your business should be ready for ATHENS, GA PAYMENT PROCESSING SETUP if you want to stay competitive. In today's fast-paced market, small businesses in Athens—from the trendy eateries in Five Points to the cozy salons in Normaltown—need efficient payment systems. These systems not only streamline transactions but also enhance customer experience, ensuring that your business thrives whether you're catering to students from UGA or professionals in Downtown Athens.

Why Payment Processing Matters

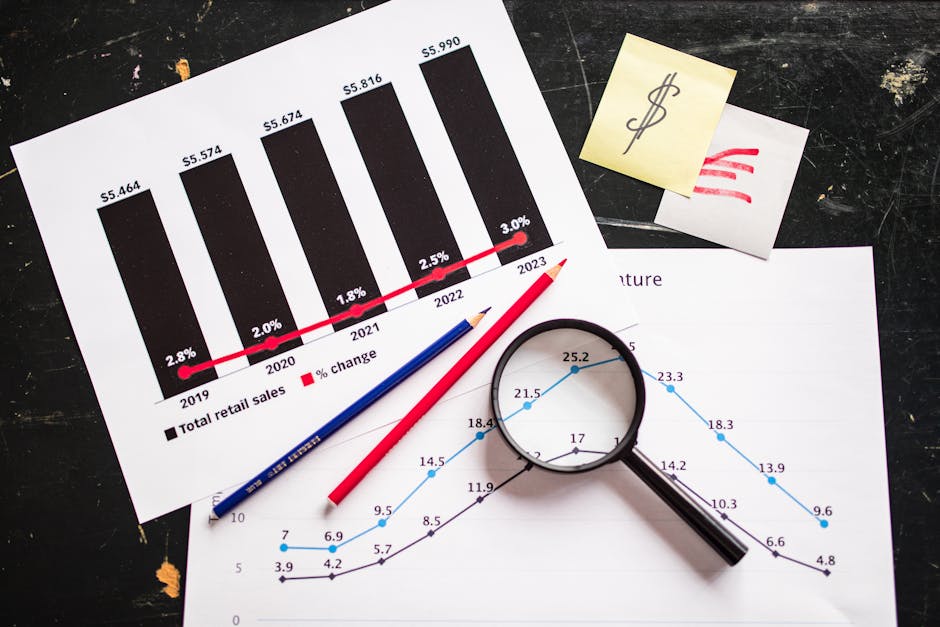

Payment processing is more than just swiping a credit card. It's about integrating a seamless, secure experience that aligns with your business goals. For example, a local coffee shop on the Eastside can benefit significantly from a robust payment system that allows for quick transactions and loyalty program integration. According to the Federal Reserve, 27% of in-person payments in 2021 were made using credit or debit cards [Source: https://www.federalreserve.gov]. Having the right setup not only keeps your business in line with trends but also opens avenues for growth.

Key Benefits of Payment Processing

- Improved Cash Flow: Payments are processed faster, ensuring your business has the liquidity it needs. This is crucial for small businesses that rely on consistent cash flow to manage daily operations and invest in growth.

- Customer Convenience: With options like contactless payments and mobile wallets, you meet customer expectations. This is particularly important in busy areas like Downtown Athens, where efficiency can make or break a sale.

- Security: Protecting customer data with secure payment systems builds trust. In a world where data breaches are increasingly common, a secure payment system can be a significant competitive advantage.

Steps to Implement Payment Processing

- Assess Your Needs: Understand what your business requires. A retail store in Downtown Athens might need different solutions than a service-based business in Five Points. Consider factors like transaction volume, customer preferences, and your existing technology infrastructure.

- Choose the Right Provider: Select a payment processor that aligns with your business size and industry. Look for providers that offer flexibility, scalability, and robust security features. It’s also beneficial if they have experience working with businesses in similar sectors.

- Integrate with Existing Systems: Ensure your payment system works seamlessly with your current setup. Compatibility with your inventory management, accounting software, and customer relationship management (CRM) systems can save time and reduce errors.

- Train Your Staff: Equip your team to handle the new payment technology efficiently. Comprehensive training ensures that your staff can confidently assist customers and troubleshoot minor issues, enhancing the overall customer experience.

Local Expertise with Axis Affiliates

At Axis Affiliates, we understand the unique needs of Athens businesses. Our comprehensive technology solutions include website development, payment processing, email setup, Google profiles, social media management, logo creation, phone systems, and digital advertising. We help businesses like yours focus on what they do best—serving customers—while we handle the tech. Whether you're a start-up or an established enterprise, our tailored services ensure your technology infrastructure supports your business ambitions.

FAQ

What are common payment processing setup mistakes businesses make?

The most common mistake is choosing a payment system that doesn't scale with the business. As your business grows, your payment processing needs may change, and having a flexible system is crucial. Another frequent error is failing to integrate the system with existing technologies, leading to operational silos and inefficiencies that can frustrate staff and customers alike.

How much does payment processing setup cost for a local business?

Costs can vary significantly based on the complexity of the system and the provider. However, Axis Affiliates offers tailored packages to suit your budget and needs. By investing in a quality setup, you're not just purchasing a service but equipping your business with the tools it needs to succeed in a competitive market.

Is payment processing setup worth the investment for small businesses?

Absolutely. With the increasing shift towards cashless transactions, having a robust payment processing system is essential for customer satisfaction and efficient business operations. It not only improves customer service but also provides valuable insights into consumer behavior, which can inform your marketing strategies and product offerings.

Related Reading

- Unlock Seamless Payments: Top Credit Solutions in Athens

- Athens, GA: Master Google Business for Local Growth

- Athens Marketing Design: Elevate Your Local Business

- Set Up Google Ads for Athens Business Success

- Unlock PayPal Power for Athens, GA Small Businesses

TL;DR

In short, ATHENS, GA PAYMENT PROCESSING SETUP is essential for local businesses to remain competitive and meet modern consumer demands. With Axis Affiliates, you can streamline the process, ensuring your business operates smoothly and efficiently. Contact us today to learn how we can help you transform your business operations.

For 2025 strategies, consider leveraging AI tools to predict customer payment preferences and incorporating blockchain for added security. These innovations can set your business apart in the Athens market.

Ready to get started? Contact Axis Affiliates and let us handle your tech, so you can focus on growing your business.